15th March 2021

Mindshare’s New Normal Tracker reveals that there is hope and happiness on the horizon for consumers

New York, Miami, London, Singapore, Shanghai, 15 March 2020:

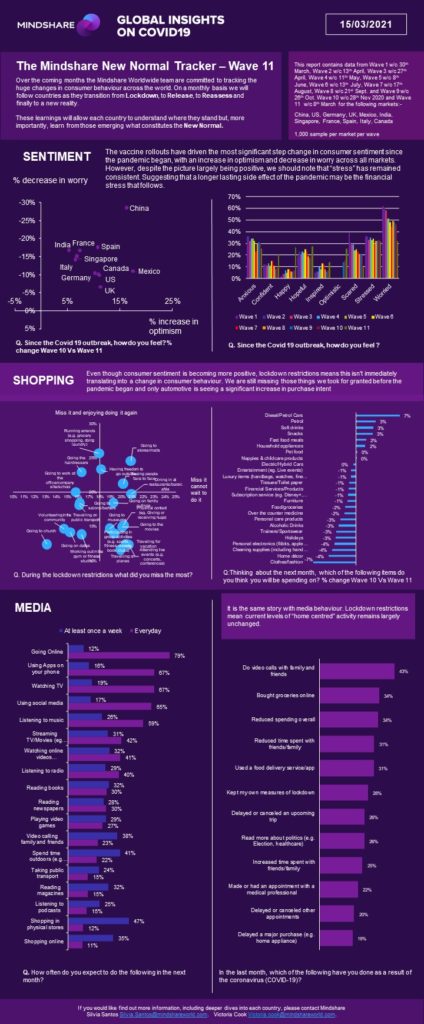

Mindshare, the agency network that is part of WPP, has released the eleventh wave of its ‘New Normal’ COVID-19 tracker - a 1,000 person per market, 10 market survey that tracks consumer behaviour in order to identify new behaviours that may become the ‘new normal’ post COVID-19.

As the roll out of vaccines takes place across the world, the first New Normal Tracker for 2021 reveals that there is hope and happiness on the horizon for consumers.

Consumers are getting used to being on their own but the stress of planning social outings with family and friends is proving an issue. There is also a sense of living the same day repeatedly as news media channels become repetitive, with an expectation that ‘new news’ will make consumers feel more positive about the future.

The New Normal Tracker has uncovered the following insights.

1. Tiredness is the general feeling for consumers at the start of 2021.

With most markets having been in and out of lockdown for a year, consumers are generally feeling tired, worried and stressed. However, markets such as China which controlled the pandemic earlier than the rest of the world, have 2 in 5 consumers feeling happy. There is hope, optimism, and happiness on the horizon, with these emotions felt by more than a quarter of the global population in February. Positivity is increasing across all markets, yet stress has remained stable in the February, which can be a potential sign of the pandemic’s longer-lasting effects and the lack of freedom experienced by consumers. Younger audiences (18-34) are more likely to have accentuated feelings and over a third of 55+ are feeling worried. The real difference is between genders, where men are more likely to be feeling hopeful (28%) and women are more likely to be worried (36%).

2. Holidays, freedom and family are the most missed things since the pandemic started.

Almost 2 in 5 consumers said that they missed going on vacation the most and cannot wait to be allowed to travel again. Family and freedom are also missed by over a third of the global population. However, dining and physical shopping, whilst missed, is still a cause for concern when restaurants and stores re-open. The activities which were the least likely to be missed were church (51%), sending children to school (47%) and travelling on public transport (41%). What has been missed the most varies depending upon market. In the UK, seeing people face-to-face is the top activity missed, whereas in France dining out ranked top. In China, where there is freedom to do most activities, going to work and hairdressers are what people have enjoyed doing most since they have been able to do so. Men and women have equally missed travelling and the older audience 55+ have mostly missed seeing people face-to-face (37%).

3. Over 3 in 5 consumers are reflecting on what is important in life.

The pandemic has brought unimaginable changes to our daily lives and it has made consumers reflect what is important to them. As most people get used to doing things on their own (60%), there is a real struggle with the uncertainty caused by the pandemic. As restrictions come and go 53% of consumers globally are finding planning social outings to be stressful. One in two people now claim to be better prepared for future crises on the back of the pandemic and over a third of consumers don’t expect life to ever return to normal. Mexico (70%) and France (68%) are the markets where the struggle with the uncertainty of the pandemic is highest. India (78%) and Mexico (77%) are being the most reflective and India (74%) and Singapore (69%) are the ones that are most likely to be getting used to doing things on their own.

4. Repetitiveness in news leaves consumers feeling like they keep living the same day over and over again.

There is a general fatigue of no ‘new news’ amongst consumers and the daily repetitiveness does feel like everyone is living the same day over and over. In Spain this feeling is felt most acutely, with 75% of consumers claiming this to be true. Given its place ahead of the curve in terms of the pandemic, China is the least likely market to be feeling this way (23%). Media consumption has also remained stable throughout the pandemic and most consumers in the next month are planning to be online daily (79%). TV and apps on mobiles also play a part of daily media consumption, with shopping and public transport still featuring lower in the priority list of media.

5. As consumers start to prioritise trusted brands, retailers are seen to have acted the most ethically in the last year.

59% of consumers globally continue to agree that these days they are purchasing from brands they know and trust and when asked which category of brands have acted most ethically, retailers have taken the top spot with 39% of global consumers picking this category. Tech companies (35%) and household cleaning brands (31%) make up the top 3 categories which have acted in an ethical way since the beginning of the pandemic. For the younger audience (18-34) trusted brands are more important than they are to the general population (63%). And despite the older audience (55+) spending more time online, they still lack the confidence of purchasing more expensive products online (22%) than their younger counterparts (45% - 18-34’s; 37% - 35-54).

For more information please contact Greg Brooks: +44(0)7826869312 | [email protected]