25th November 2020

Mindshare New Normal Tracker reveals second wave of pandemic and lockdowns forcing consumers to consider big life changes and focus more on their mental health

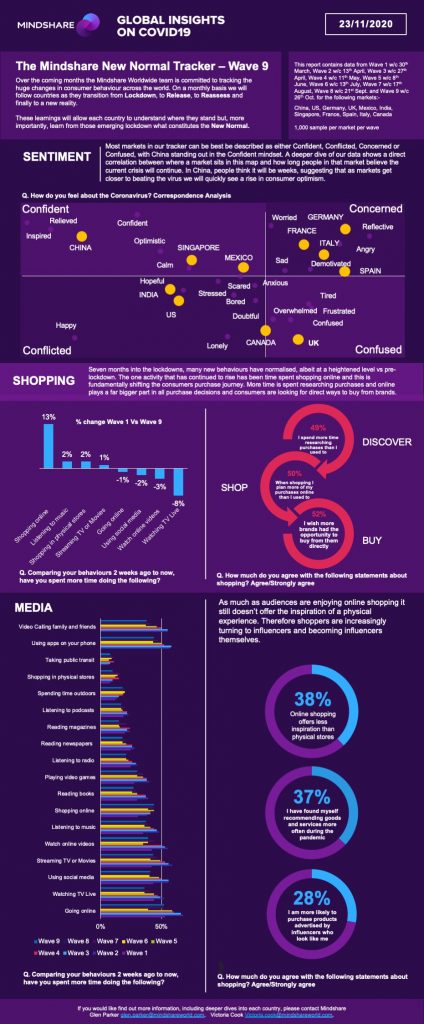

New York, Miami, London, Singapore, Shanghai, 23 November 2020: Mindshare, the agency network that is part of WPP, has released the ninth wave of its ‘New Normal’ COVID-19 tracker - a 1,000 person per market survey across 10 global markets that tracks changes in consumer behaviour in order to identify new behaviours that may become the ‘new normal’ post COVID-19.

As Europe enters a second wave of Covid-19 and national lockdowns are again imposed, consumers globally continue to feel worried, stressed and anxious. They are also feeling tired and sad by the whole situation. Wave 9 data shows how consumers are starting to feel the impact of the measures imposed and how they have used this time to reflect on what is important to them.

Wave 9 data collected w/c 26th Oct uncovered the following key insights which allow us to understand the consumer mindset across different areas of their lives.

- Two thirds of consumers taking more time to reflect on what is important to their life.

Eight months into the pandemic, consumers globally have started to feel tired of the situation (22%) and whilst worry (48%) and stress (32%) are the most predominant feelings, there is also a sense of sadness (21%) being experienced. Women are more likely to be feeling tired (25%) than men (19%) but it is the younger age group 18-24’s who are feeling like this the most (26%). Markets hardest affected by the pandemic during the first wave are also more likely to feel more worried than the global population, as more than 1 in 2 consumers in Italy and Spain are claiming ‘worry’ as their most felt sentiment on the pandemic. Consumers have also adapted to the new way of living and some are taking the extra time to really reflect on what is important to them. Again, globally women are more likely to be doing this (63%). Amongst the total population in the markets tracked; India (77%), Mexico (76%), US (61%) and China (55%) are also reflecting on what is important.

- Consumers struggle to maintain relationships but are trying to make big positive changes.

We see 52% of consumers globally saying that they are taking steps to make big positive changes as an impact of the pandemic. However, there is a sense of loneliness as 58% of consumers are also getting used to spending more time on their own or doing things on their own. Younger generations feel the impact of the pandemic the most, with 60% of 18-34s most likely to spend more time on their own or doing things on their own. During the pandemic, 42% have also struggled to maintain relationships with friends/family or even romantically. Women are the ones driving personal positive changes (53%) and getting used to doing things on their own (61%). When it comes to the struggle of relationships this is felt equally by both women and men.

- Grocery shopping trips are more efficient, with less time being spent in physical stores.

57% of consumers globally are claiming to do their groceries more efficiently than prior to the pandemic and it is those in the 25-44 age group who are the most likely to be doing this. During the pandemic, consumers have also claimed to have kept their home well stocked up to ensure they had enough food and supplies (56%) and it is brands that are known and trusted that consumers are turning to (56%). Consumers would also welcome the opportunity to purchase directly from brands (52%). More than 1 in 2 consumers are also spending less time in store browsing, this is even truer in the UK (62%) and in the US (63%). And whilst a over a third agree that online shopping is less inspiring than shopping in store, 86% are still shopping online more or roughly the same as they did in the last month.

- Half of consumers have become more aware of their mental health.

As the pandemic takes its toll on the economy, 1 in 2 consumers are worrying a lot about their finances and 41% are more worried about their finances than the actual virus itself. Consumers are also aware of the impact of the virus on their mental health, as 1 in 2 are more aware of it than they were prior to the pandemic. It is those who are younger who are the most aware with 56% of 18-34’s agreeing to being more aware, but when we look at men versus women the numbers are telling as it’s almost evenly split on those who agree to being more aware of the state of their mental health. Interestingly, looking at the markets covered, it is India (72%), Mexico (70%) which are still experiencing a surge in cases and China (65%) who have almost eradicated the pandemic who are the most aware of their mental health.

- Travelling on planes remains the biggest concern amongst consumers globally.

46% of consumers globally are concerned and have not travelled on planes since the beginning of the pandemic. There is, however, a minority of those who are concerned but have had to travel (15%). Only 10% of those who have travelled are not concerned about it. Apart from travelling, consumers are also concerned with attending live events (46%) and going to the movies (45%). Running errands and shopping in general, generates the most concern yet consumers are not stopping this behaviour, as 1 in 2 who said they were concerned about running errands still did them. France and Canada are the markets with the highest concern of errand running at 56% and 57% respectively. Germany on the other hand has the least number of consumers concerned with this activity as only 37% claim to be concerned and have done it.

- A country’s current situation of the pandemic influences how its consumers feel.

Using the sentiment data and looking at the correlation of how consumers feel and where the markets are in their current crisis has identified 4 sentiment areas – Confident, Concerned, Conflicted and Confused. China, Mexico and Singapore are defined as the most confident markets out of the 10 tracked, where consumers are generally feeling optimistic, confident and calm. Spain, Italy, Germany and France, which are back to full lockdown have consumers expressing worry, demotivation and sadness in general. UK is the country most likely to have consumers feeling confused, frustrated, overwhelmed and tired and Canada sits between Conflicted and Confused. India and US are also conflicted in their feelings as there is a sense of hope but also stress and doubt.

For more information please contact Greg Brooks: +44(0)7826869312 | [email protected]