24th September 2020

Mindshare New Normal Tracker reveals consumers have returned to a state of worry, anxiety and stress resembling the same levels as June

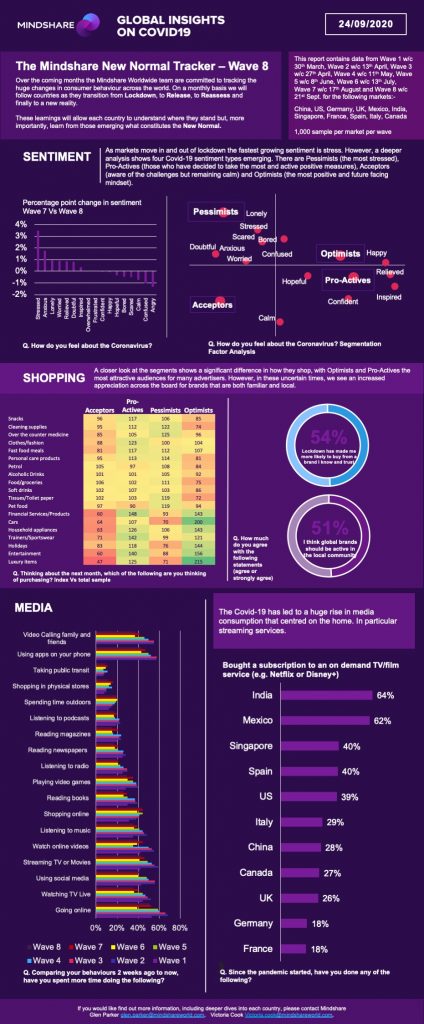

New York, Miami, London, Singapore, Shanghai, 24th September 2020: Mindshare, the agency network that is part of WPP, has released the eighth wave of its ‘New Normal’ COVID-19 tracker - a 1,000 person per market survey across 10 global markets that tracks changes in consumer behaviour in order to identify new behaviours that may become the ‘new normal’ post COVID-19.

Wave 8 data has shown that consumers have returned to a state of worry, anxiety and stress resembling the same levels as June. There is also a clear indication that financial impact from the pandemic is causing more concern than the virus itself.

Wave 8 data – w/c 21st September showed the following key insights:

- Lockdown has put pressure on brands to act local, build loyalty and gain trust

More than 1 in 2 consumers globally agree that lockdown has made them more likely to buy from brands they know and trust. It is the younger age groups that are more loyal to brands with almost 3 in 5 saying so. Yet, consumers in France (28%), Germany (38%) and Spain (47%) are less likely to agree to this. There is also a desire for brands to act local and support the local communities, as 51% prefer global companies who are actively playing a part in the local community, with India (80%) and China (65%) being the most likely to agree. The ongoing travel restrictions across the world has also meant that consumers across the globe have an increased interest in exploring their own country, 64% are claiming to be interested and 63% are not willing to go to any new locations whilst the pandemic is still going on.

- Countries hardest hit by the pandemic blame people not taking it seriously enough

70% of consumers globally agree that people are not taking the virus seriously, this is particularly true of countries that have been hard hit by the pandemic such as India (83%) and Mexico (89%). It is also the older age group that are most likely to agree with this as 77% of those aged 65+ claim this to be true. Consumers also feel the need to retain their own protective measures to safeguard their own health and 70% globally claim to have done so. Again, Mexico and India are the countries where consumers are claiming to be doing this more than the global average at 87% and 89% respectively, but also 79% of those in China are also keeping their own measures to protect their health. The financial impacts felt by the pandemic are more of a concern than the virus itself for 50% of the global population and it is those with higher incomes who are the most concerned with their financial status. There is also a concern for those in the younger age groups 25-34 with 59% agreeing to this.

- Rising levels of stress, worry and anxiety as consumers do not expect life to return to normal

As the second wave of the pandemic takes its toll across many countries around the globe and local lockdowns continue to occur, consumers are becoming more stressed (at 32% up by +3ppt since August). The dominating feeling towards the pandemic is still worry with 49% of consumers saying they feel worried and back to the levels felt in June. The uncertainty of the whole situation has also made consumers anxious, the highest increase on the previous month to 30% (up by 7ppt). The sentiments are reflected in the consumer expectations of life returning to normal, as 47% are not expecting this to ever happen and of those who are more optimistic, a third think it will take over a year to get normality. Across markets, the scenario is similar with 63% of consumers in Singapore not expecting their lives to ever go back to normal and European markets such as UK and France have over 50% of people agreeing to this. Despite being hit hard, Spain is the most optimistic, with only 39% of consumers not expecting normality to return.

- Media consumption stabilises but the lockdown winners are subscription services

Digital and live TV were the amongst the media which saw an increase in consumption during the pandemic. Some activities, whilst less consumed now than back in March, still have high consumption: going online (51% more than before), streaming TV/Movies (43% more than before) and online shopping (43% more than before). Streaming TV/Movies has seen an average of 49% of consumers claiming to be doing it more than before, since the start of the pandemic. The increase in consumption could be impacted by the uptake of new subscriptions, as 35% of consumers globally have claimed to have bought a subscription service to on demand platforms such as Netflix and Disney+ and a further 13% are thinking of doing so in the future. In Mexico and India, the number of consumers claiming to have bought a subscription service is almost double that of the global population at 64% and 61% respectively. Future growth of these platforms could come from China as 24% of consumers are thinking of purchasing a subscription in the future. The purchase globally is almost equally split between men and women (51% vs. 49%) and it is the 25-44 who are the buying these services the most (51%).

- Despite previous experience, shoppers still believe in the need to stockpile before an impending lockdown

Planned purchases in the next month will be mainly for household basics such as food (77%), cleaning supplies (60%) and personal care products (58%). These claims to purchase were the highest since tracking began back in June. The highest increase however was for toilet paper/tissues from wave on wave by 10ppts to 57% as the UK started to implement quantity control to certain items across various supermarkets to avoid the lack of products on shelves seen at the start of lockdown. 62% of consumers globally also agreed they are making sure their home is well stocked up with food and supplies, an increase of 6ppts on the previous month when 56% of consumers agreed. Consumers in the US and China are even more likely to agree to stocking up on foods and supplies at 74% (up from 45% in the US and up from 62% in China).

For more information please contact Greg Brooks: +44(0)7826869312 | [email protected]