13th January 2020

2020 will see epic TV content wars, but will UK consumers sign-up for more streaming services?

New research has found less than 10% of UK consumers would consider adding to the streaming subscriptions they already have, and one in six (57%) say with so many video subscription services emerging, it’s hard to choose what to pay for.

As part of our 2020 Trends report we're questioning whether growth in the subscription market will be able to match the huge levels of investment being made in the launch of new and existing TV streaming channels – especially with Disney having recently said it already anticipates its streaming services being a drag on its bottom line until 2024.

As part of our wider trend around content and the future of entertainment, our research into the future of streaming services in the UK found nearly three quarters (71%) of consumers who currently subscribe to paid streaming services plan to continue their subscriptions, with only 8% saying they will take out additional subscriptions or switch existing subscriptions for new ones.

However, with the arrival of BritBox and Apple TV+ in the UK last month and expected 2020 launches of Disney+, NBC’s Peacock and mobile-only streaming service Quibi, our Futures study suggests that the abundance of choice and the prospect of adding new services to the mix has left consumers feeling overwhelmed. Six in ten Brits (57%) say the emergence of so many services has made it hard to choose what to pay for, and the idea of managing multiple accounts and payments is a source of growing frustration.

Over a third (35%) claim they’d be interested in a simpler solution where they only pay once. Asked which provider would be the preferred choice to offer all the content users want, Netflix (22%), BBC (21%) and Sky (18%) come out on top.

The research indicated there is still much ground to be covered for the impending UK launch of Disney+ - whilst 9 in 10 of Brits have heard of the service, less than one in five (19%) say they would consider paying for it, and almost two thirds (64%) would not consider subscribing to it.

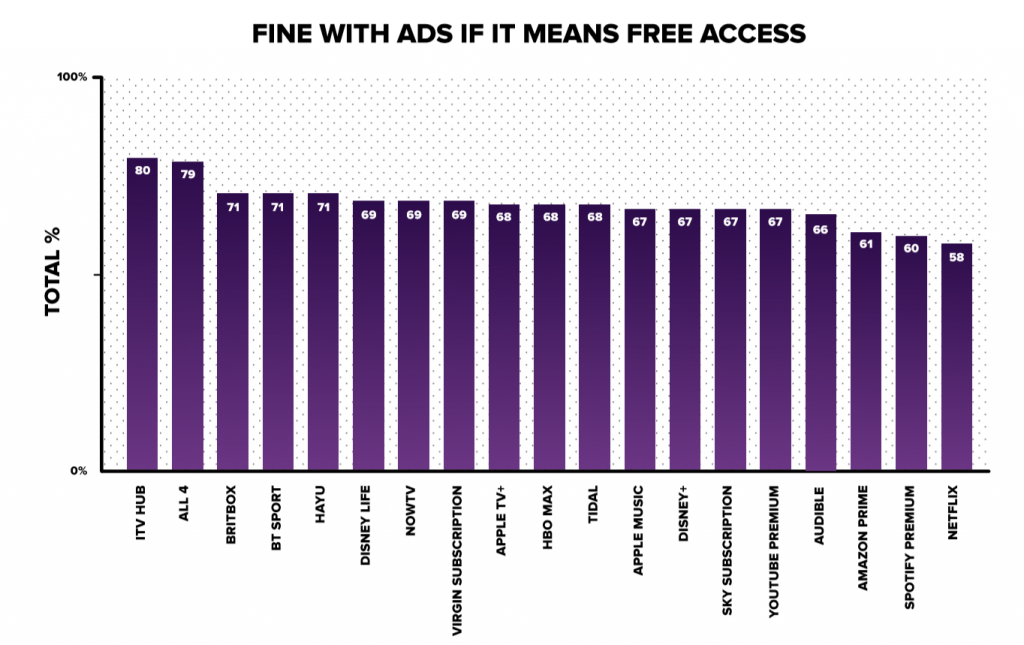

Two thirds of Brits (64%) say so many new streaming services mean it will get too expensive to access everything they want to watch. But, in good news for brands, this may open-up more opportunities for ad funded models - more than half (55%) of consumers do not mind seeing commercials on streaming services if it means they get access to free content they enjoy. When asked about the individual streaming services, most users were happy to see ads if they were able to watch or listen to the service for free.

Scott Whitton, Head of AV at Mindshare commented: “The TV industry has never been more dynamic, but media companies seeking to unlock subscription revenue streams must think carefully about how they can achieve the required share of eyeballs to make their investments pay. Our study suggests viewers will not buy into new streaming services just because they are there and a far more sophisticated approach to understanding audiences and their preferences and tastes is required.

“Advertising on streamed TV channels may be a way to encourage new adoption, through making access more affordable for some audiences. Bundling of services to provide a single, simpler point of access to multiple streaming brands may also be key. In the end the people will decide whether so much more TV choice is sustainable.”

Fig 1: Which of these platforms would you be happy to see ads on if it meant free access?