19th May 2020

Mindshare New Normal Tracker Reveals Online Media Consumption Reducing As Lockdowns Lift But Online Shopping Still Increasing

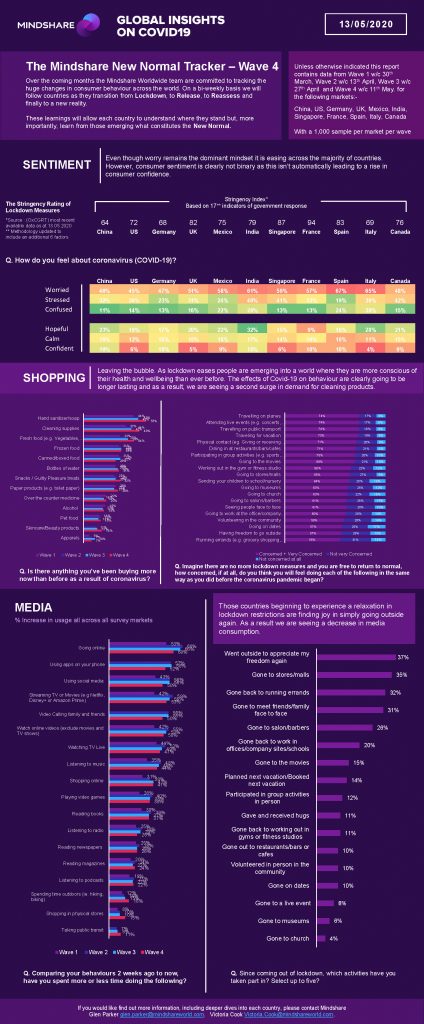

New York, Miami, London, Singapore, Shanghai, 19th May 2020: Mindshare, the agency network that is part of WPP, has released the fourth wave of its ‘New Normal’ COVID-19 tracker - a 1,000 person per market survey across 10 global markets that tracks changes in consumer behaviour in order to identify new behaviours that may become the ‘new normal’ post COVID-19.

Wave four data shows that the spikes in usage of online media around the world are by and large beginning to drop in line with markets coming out of lockdown and getting access to more physical freedoms. However, the trend of online shopping continues to increase, even though some markets have now lifted restrictions on many forms of physical shopping.

Wave 4 data - W/C 11th May - showed key insights around consumer sentiment, shopping and behaviours.

There were 5 main insights from the latest wave which indicate what we may expect in the ‘new normal’:

- The first seeds of shifting behaviour back to include outdoor and physical shops, hinting at less time in the future spent online.

While still the dominant media behaviour, going online and watching Live TV have been trending downwards on the amount of time spent over the last two weeks (Wave 2 to Wave 4 numbers show an 8% drop in going online, 5% drop in live TV and 6% drop in streaming). While the numbers aren’t big, it is a consistent decrease as the number of people going outdoors, shopping in physical stores and taking public transport has increased. This trend could indicate that as we return to a more ‘normal’ routine, including workplaces, that media consumption will rebalance.

- Shopping habits are still increasing across most areas.

One trend that isn’t showing a decline however is shopping online, which has been steady over the last two waves with 41% of people saying it is something they have done more of in the last two weeks. This may hint to the future where we are more comfortable shopping online in general. As for what we are buying - having seen a slight decline in previous waves hand sanitiser (55%), cleaning supplies (49%) and paper products (30%) have gone up again which may hint to the end of the stockpiling and more availability of stock. Fresh food (44%) and snacks (43%) both continue to increase so there is still a good market for all food products and the only area that has shown a consistent decline is for canned or boxed food, down 5% since its peak.

- Going shopping and running errands is top of our list when released from lockdown.

For those markets where lockdown has eased, we have seen the first data on post lockdown activities starting to emerge. Going to stores / malls globally is something 35% of those in ‘unlocked’ markets have done, however this number is boosted by China at 45%. Most other countries focus on seeing friends and family at 31% closely followed by going to salons or barbers at 31%. Going to restaurants or cafes is still the lowest activity at only 10%.

- While we are all still worried there are seeds of more positive emotions

Whilst the predominant feeling across the world is still ‘worry’, we have seen a decrease from the first wave of 62% to 51% of people feeling this way - as people start to adjust to the new normal. People are starting to feel hopeful (23%), confident (13%) an inspired (10%), although many are also just bored (21%). Across the world, Italy and Germany are the most doubtful at 32% as some of the restrictions start to ease. India and Italy are the most confused at 28% and 30% respectively. Mexicans are the most overwhelmed 25% but we are still seeing the positive reaction from China, with Chinese consumers being twice as likely to say they are relieved and inspired.

- Just because people are allowed to do and activity doesn’t mean that they aren’t concerned about it

The activities people miss the most goes hand in hand with what they are most concerned about. Whilst only 10% have been to a restaurant, 34% are missing doing it and 61% are concerned about doing it in the future. The highest concerns are around live events at 66%, restaurants 61% and giving and receiving hugs at 60%.

For more information please contact Greg Brooks: +44(0)7826869312 | [email protected]