24th August 2020

Mindshare New Normal Tracker Reveals Hunkering Down Behaviours Returning and Self-Imposed Lockdown Measures Over Fears of Second Wave of the Pandemic

Mindshare New Normal Tracker reveals hunkering down behaviours returning as consumers worry of a second wave of the pandemic and have self-imposed their own lockdown measures to protect themselves.

New York, Miami, London, Singapore, Shanghai, 21st August 2020: Mindshare, the agency network that is part of WPP, has released the seventh wave of its ‘New Normal’ COVID-19 tracker - a 1,000 person per market survey across 10 global markets that tracks changes in consumer behaviour in order to identify new behaviours that may become the ‘new normal’ post COVID-19.

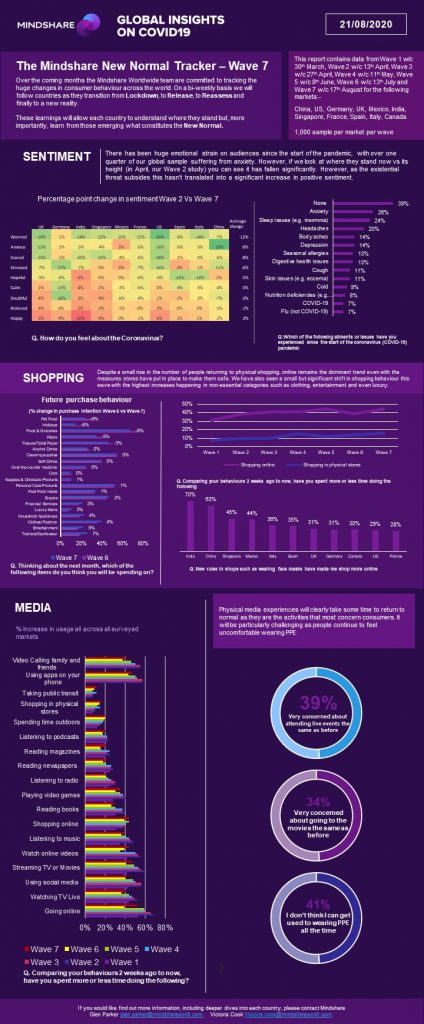

Wave 7 data reveals that consumers’ media consumption has increased to similar levels to those just prior to ease of lockdown. Again, it is online activities that are dominating and the continuing rise of online shopping. Sleep issues and anxiety are also claimed to be some of the health issues consumers have started to experience since the start of the pandemic.

Wave 7 data - W/C 15th August showed five key insights:

- Consumers are going back to lockdown levels of media consumption

The previous waves showed a slight decrease in general media consumption, except for digital activities, as countries came out of lockdown. This wave, as local lockdowns have been imposed by some countries, media has again become the escapism for consumers. Traditional media such as watching live TV, reading magazines and newspapers have also increased on the previous wave, but it is shopping online and streaming that have been established as behaviours that are here to stay. 44% of global consumers are shopping online more than before and of these, 75% say they will continue to do so in the future. More people are streaming than before (46% of the global population) with this behaviour mostly in the younger age group (58% for 18-34), but the over 55s are also claiming to be doing more of this activity (42%) just slightly below the global average.

- Sleep and anxiety are the main health issues suffered by consumers since the start of the pandemic

With the financial impact of the global pandemic taking its toll on consumers (67% are now claiming to have been financially affected by the situation), new health issues have also been experienced by consumers. The top main issues related to health are anxiety (26%), sleep (24%) and headaches (20%). These issues are felt mostly by those who are younger (18-34) but there is a slight difference by gender. For women, their top health issue is sleep (29%) whereas for men it’s anxiety (23%). Of those who have claimed to suffer from sleep and anxiety issues, 1 in 2 are also worried of future lockdowns and their financial circumstances.

- Confusion, frustration and anger have increased but so has the acceptance of the situation

Since the beginning of the pandemic, worry and stress have been the top two consistent feelings for consumers. However, wave on wave, those claiming to feel this way has been decreasing (worry was 62% in wave 1 down to 44% in wave 7 and stress 36% to 29%), although in the past month the feeling of frustration (24%), confusion (17%) and even anger (14%) has increased. The lack of feelings for this situation has also been steadily increasing (2% in wave 1 to 6% in wave 7) as people are just accepting it. USA and Germany are the countries to have less feelings around Covid-19 at 13% and 8% respectively as Spain, Italy, Mexico and India are the markets that are least accepting with only 2% of their respective population claiming to have no feelings regarding the pandemic.

- Big events have been postponed till 2021 as the desire for own country exploration has been triggered by the travel restrictions

40% of the global population have delayed big life events such as marriage/children and job changes until 2021. Mexico (45%), India (65%) and China (44%) are the markets in which consumers are agreeing most to this delay and it comes as no surprise that it is those in the younger age group (18-34) that have put these on hold till next year (44%). The travel restrictions have also made consumers more interested in exploring their own country (53%) and this is true for all ages and all markets but even more so for China (62%) and India (64%).

- Consumers continue to worry of a second lockdown and are taking protective measures to safeguard own health

Worry of returning to lockdown remains high globally (48%) and this worry is felt most by those in the 35-44 (51%) age group and the over 65’s (50%). 58% of the older age group is not feeling optimistic and do not think the situation will get better before it gets worse. For markets where local lockdowns are being imposed, the worry is higher, 55% for UK and 66% in Spain and 63% in Italy. Consumers are also taking their own lockdown measures to protect their health (61% claim to do so), predominantly those in the 35-44 age group (62%) and this number goes up to over 70% amongst those who have suffered from health issues.

For more information please contact Greg Brooks: +44(0)7826869312 | [email protected]