26th May 2022

InMind: Tracking COVID's Impact in China (May 2022)

Mindshare’s InMind report series helps brands keep the latest growth opportunities on media, consumers and markets in mind.

The current COVID-19 outbreak in China that started early March has affected, and continues to affect, different parts of China in distinct ways.

The situation in any one market can change significantly in days, if not hours.

To help marketers in China adapt to these conditions, Mindshare China has been releasing bi-weekly COVID updates to track lockdowns, economic impacts and changes to consumer media behavior.[1]

Case Numbers: Overall positive signs, yet city-level caution remains

At a national level, daily new cases continue to decline from their peak on April 21st (30,557 cases).[2] However, the story for individual cities is different: Shanghai’s 7-day average case numbers are the best they’ve been since March 23rd; Changchun has recorded multiple ‘zero days’, yet Beijing is still continuing to see cases rise.[3]

Economic Impact: April data shows broad effects of COVID across the country and sectors

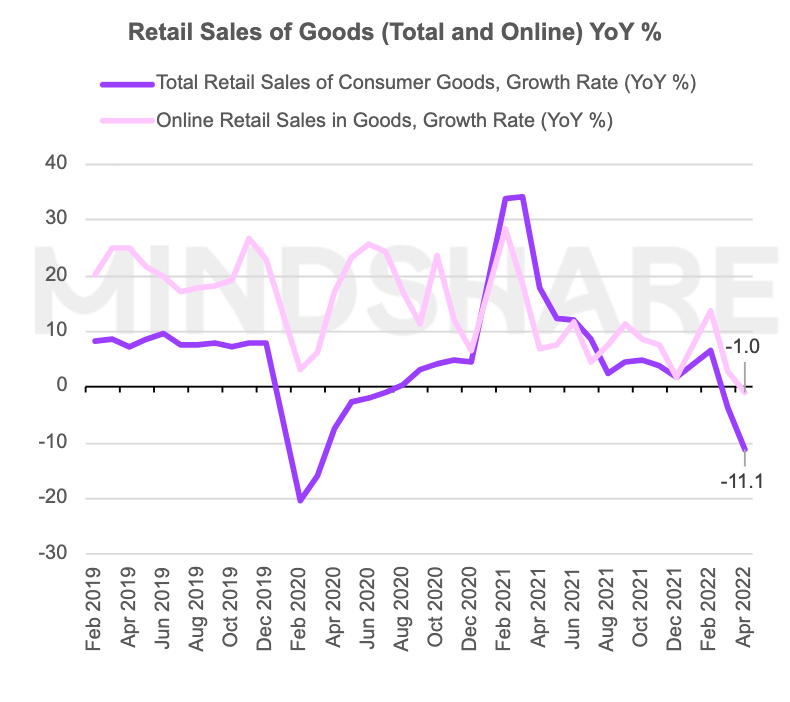

In the April economic release, we saw the full-month national impact of COVID control measures. Total retail sales of consumer goods declined -11.1% year-on-year, while online sales of consumer goods declined -1%.[4] These numbers, despite the relatively localized restrictions when compared to 2020, show the far-reaching impact of the outbreak.

Beyond consumer spending, overall economic activity showed a slowdown in April: cement output was down -18.9% year-on-year, total electricity output was down -4.3%. Youth unemployment (16-24) also grew to 18.2% in April, exceeding 2020’s high.[5]

Mindshare China analyses congestion (road traffic) data for 100 cities to track the on-the-ground effect of COVID control measures across the country. As of May 22nd, just six cities showed significant slowdowns (<-25% from historic average), the best conditions since early March. Still, however, many major cities are showing a slowdown in commuter subway traffic, as work from home remains a feature of city life.[6]

Media Impact: Signs of normalization

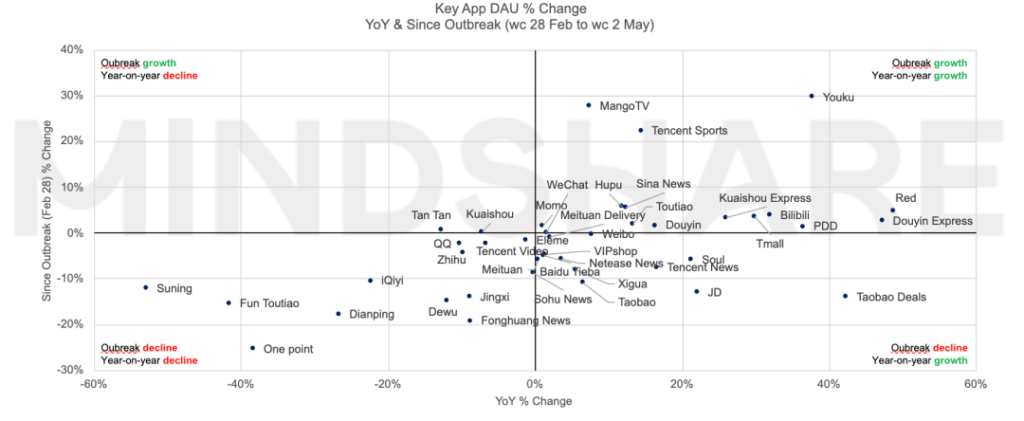

In recent weeks, we’ve observed some moderation in app behavior. Short video usage has decreased from its initial spike and life services are recovering. Hit shows have driven audience increases for Mango, Youku and Tencent Sports.

This being said, Meituan Maicai and Dingdong have both held onto their user growth, while WeChat’s user time spent remains elevated and Red has continued to see user time spent growth over the past few months. Time spent on eCommerce apps Taobao, Taobao Deals and JD remain at c.-10% since start of the outbreak.

The situation continues to evolve and have distinct impacts on different parts of China. We continue to monitor conditions across markets, media and consumer behaviour.

Should you have any questions on how Mindshare China can assist in your planning during this time, please get in contact. To receive the full COVID-19 Impact report or get further information, please contact us at [email protected]

Data Sources:

- Note on Data Recency: National and local COVID-19 case numbers up to May 22nd; Monthly economic, eCommerce data up to April; 100-City Congestion data up to May 22nd; Subway data up to May 21st; Truck Index up to May 11th; App data up to w/c May 9th

- Our World in Data

- China Health Commission

- National Bureau of Statistics China

- Ibid

- Wind; Gaode; Mindshare China analysis

To learn more about Mindshare China, scan the QR code and follow our official WeChat account.