25th June 2020

Mindshare New Normal Tracker Reveals Younger Demographics Feel Most Financially Impacted by COVID-19 and Lockdowns

New York, Miami, London, Singapore,

Shanghai, 25th June 2020: Mindshare, the agency network that is part of WPP,

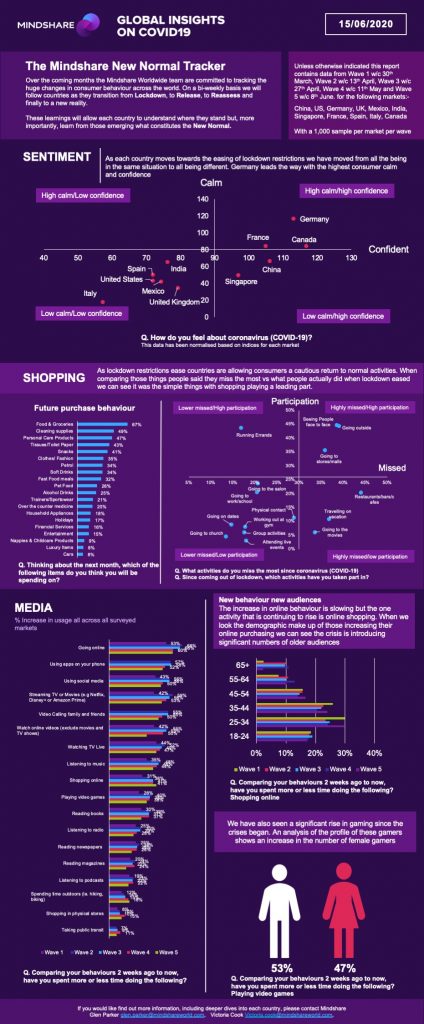

has released the fifth wave of its ‘New Normal’ COVID-19 tracker - a 1,000

person per market survey across 10 global markets that tracks changes in

consumer behaviour in order to identify new behaviours that may become the ‘new

normal’ post COVID-19.

Wave 5 data shows how

COVID-19 is impacting consumers financially across the globe and as shops begin

to reopen and market unlock, how consumers are re-thinking their purchases and

spending power.

Wave 5 data - W/C 8th June, together with social conversations, showed 5

key insights:

- Almost 3 in 10 people globally have been ‘very affected’ financially

Countries such as India (85%), Mexico (79%) and Singapore (77%) have seen the biggest impact, whereas China is the least affected (48%).

- The younger generations feel the most affected financially, as the older generations have felt less impact

The younger generations have seen the biggest impact of the pandemic on a financial level. Across the markets tracked, 18-34 year olds were the most affected financially and the 65+ age group the least affected. This group can now expect marketing strategies to switch towards them with the assurance that they have money to spend. Analysing the gender split of this impact, women seem to be generally more affected than men but not significantly so. By market, China is the least impacted whereas India has over 80% of 18-34’s being impacted financially by the virus. Mexico is resisting the trend, as the most impacted are the 35-44 workforce.

- Boredom is taking over.

Most consumers are still feeling worried as the pandemic situation has no signs of slowing down, however this sentiment has decreased in the last 5 waves and whilst in March more than 6 in 10 people were claiming to be worried, it has now stabilised to just over 50%. There is however an increase in boredom, in the last month alone it increased from 1 in 5 people to 1 in 4 people claiming this sentiment. In countries such as Singapore, this sentiment is even more evident as the people claiming to be bored is 2 in 5.

- Online shopping continues to grow

With many countries still easing lockdown measures, the only aspect of life that has become the norm is online shopping. Since the beginning of the pandemic and tracking back to March, the number of consumers doing online shopping ‘more than before’ was 31%. It has now increased to almost 1 in 2. China, where the lockdown measures were lifted back in April, is leading this trend with 61% of consumers claiming to do more online shopping now than prior to the pandemic. Interestingly, the older generations (55+) who only had 5% claiming to be shopping online more in the first wave, has now seen this number jump to 33%.

- Consumers want to return to normal

In the latest wave, 6 in 10 people said they ‘cannot wait to go back to normal’ and this is highest for markets such as Singapore 72%, US 69% and UK 67%, where lockdown measures were less strict than some of the European markets but crucially where the lockdowns have lasted longer. Consumers are also expecting brands to return to more normal marketing, as 1 in 2 want to see brand advertising reflective of normal daily life. China and India again indicate a higher need of wanting brands to go back to normal with 60% wanting advertising back to how it was. There is also a desire to treat oneself following the hardship of lockdown, as a quarter of consumers agree that they will be treating themselves to luxury items once it is all over. US and Singapore lead this trend.

For more information please contact Greg Brooks: +44(0)7826869312 | [email protected]